Executive Summary

On June 24, 2025, Haitham Abdallah Bakri, the manager of the exchange office “Al-Sadiq”, was eliminated in an Israeli targeted strike. Bakri was a central figure in Hezbollah’s financial axis.

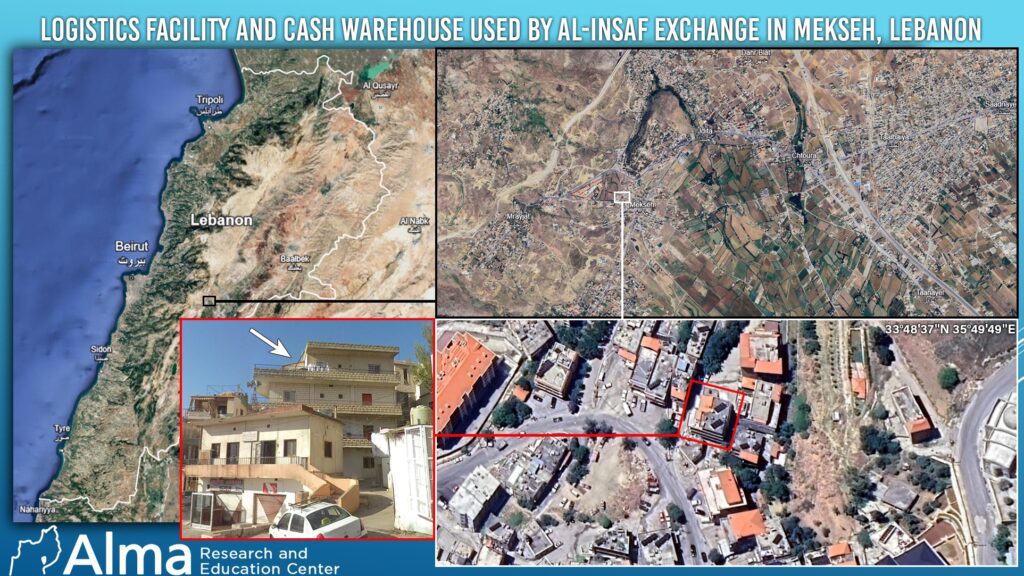

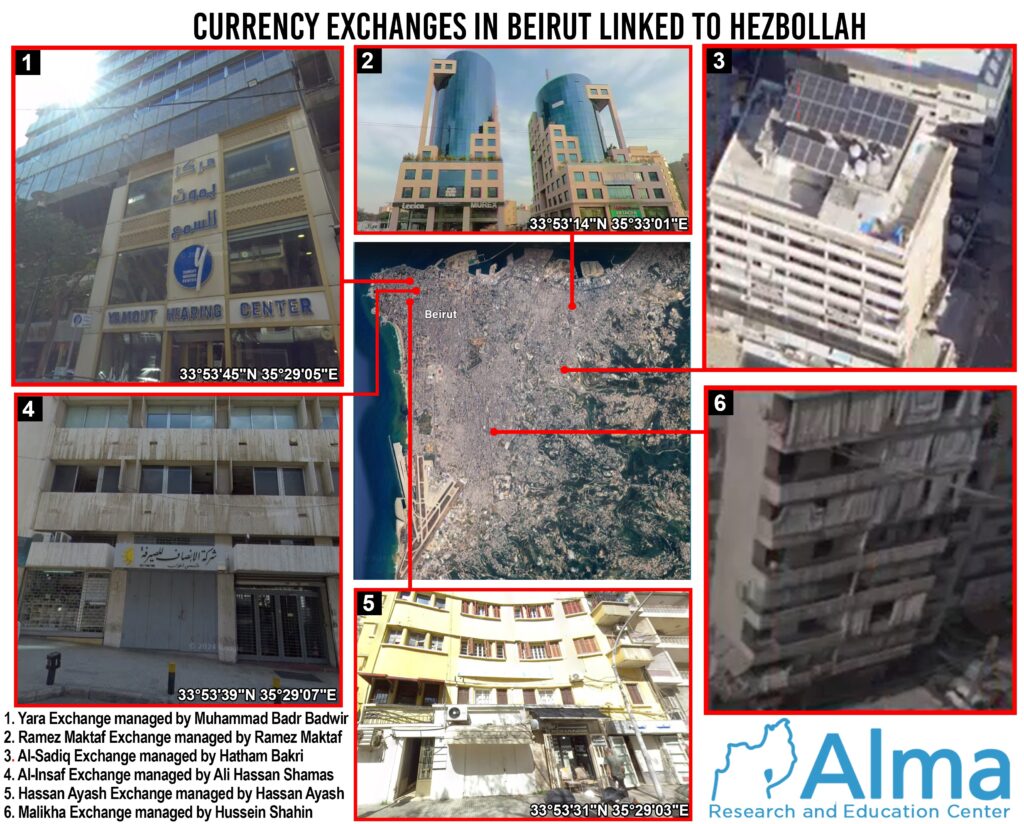

The “Al-Sadiq” office is one of six Lebanese exchange offices that constitute a significant component of Hezbollah’s terror financing mechanism (the others: “Mecattaf”, “Yara”, “Al-Insaf”, “Maliha”, “Hassan Ayash”). Through them, funds are channeled to Hezbollah from Iranian sources, global donations, and worldwide criminal activity. Their operation is disguised as legitimate, taking advantage of legal licensing in Lebanon and lack of enforcement.

Key Insights

- The exchange offices are a strategic link in Hezbollah’s financial network, used for military and civilian funding and for money laundering.

- The “Hawala” method allows international money transfers without digital traces, via settlements between exchangers in different countries. There is no banking oversight and no documentation – enabling flexibility, survivability, decentralization, and evasion of sanctions and intelligence monitoring, all while exploiting legitimate business ties.

- Loose oversight in Lebanon, corruption, and fear of confrontation with Hezbollah allow these offices to continue operating, some with licenses from the Lebanese Central Bank.

Recommendations to the International Community, Led by the United States

- Imposing international sanctions and demanding state-level license revocation for all six offices and their personnel – currently only the “Hassan Ayash” office is officially designated.

- Demand a financial investigation into the links between “Mecattaf” and “Saradar Bank” and the possibility of Hezbollah-related activity in Saradar Bank due to cross-ownership by Ramez Mecattaf.

- Demand the effective implementation of oversight following Instruction 13735 of the Lebanese Central Bank (July 14, 2025), aimed at combating money laundering and terrorism financing, given concerns it won’t be implemented due to political considerations and Hezbollah pressure.

General

On June 24, 2025, Israel carried out a targeted strike against an ostensibly civilian target – Haitham Abdallah Bakri – the manager and owner of the exchange office “Al-Sadiq” (“The Honest”/”The Just”). The target was not a minor money changer, but a central key figure in Hezbollah’s financial system and terrorist fund transfer infrastructure. This is an excellent example of the fact that not every terrorist carries a weapon.

Bakri’s elimination followed the elimination in Iran (June 21) of the commander of Unit 190 of the Quds Force of the Iranian Revolutionary Guards (Behnam Shahriari). Unit 190 is responsible, among other things, for the logistics of transferring funds from Iran to Lebanon.

The “Al-Sadiq” exchange office is one of six key Lebanese currency exchange offices linked to Hezbollah’s financing axis, whose primary source is Iranian money transferred to Hezbollah by the Iranian Quds Force, which typically channels the funds through Iraq, Turkey, and the United Arab Emirates.

Additional sources may include the many donations collected from Shiite communities around the world and various forms of criminal activity in which Hezbollah is involved globally.

According to an IDF spokesperson’s statement, the five other exchange offices associated with Hezbollah’s financing axis are: “Mecattaf”, “Yara”, “Al-Insaf”, “Maliha”, and “Hassan Ayash”, all of which have their main offices located in Beirut.

Hezbollah: Financing Infrastructure – Including Exchange Offices – A Strategic Component in Reconstruction Capability

Hezbollah’s financial infrastructure constitutes a strategic component in the organization’s ability to recover after the war. A central pillar of these infrastructures is the network of currency exchange offices.

The main gap revealed during the drafting of this report concerns the weakness of governmental oversight in Lebanon: these exchange offices operate under legal licenses cooperating with recognized financial institutions. However, enforcement mechanisms are almost entirely absent in Lebanon, compounded by political corruption and a reluctance to confront Hezbollah. This enables Hezbollah to operate a covert yet well-established self-financing network. The result is an almost unrestricted sphere for the transfer of funds.

Over time, the exchange axis has developed into a system that operates under the radar, resilient to sanctions, and characterized by redundancy, flexibility, and survivability. The Lebanese currency exchange network is a dense web of offices, kiosks, and small businesses that facilitate fund transfers without banking oversight and, at times, without any documentation at all. While most of the public uses exchange services for legitimate civilian purposes, for Hezbollah, this system represents a critical lifeline — especially in the current period.

Through the aforementioned exchange offices, Hezbollah manages to secretly and consistently transfer millions of dollars to fund both its civilian and military operations. The exchange axis is used for money laundering, salary payments, funding associations and civilian organizations affiliated with Hezbollah’s Executive Council, and arms procurement — all while evading Lebanon’s formal banking system and international oversight.

Hezbollah is Not Alone

Hezbollah, of course, is not alone in using this method. Over the past decade, terrorist organizations around the world — from al-Qaeda to ISIS, from Hamas to Islamic Jihad — have discovered the Hawala system for transferring funds. It is a simple yet sophisticated method, flexible and almost impossible to enforce.

This method is based on a straightforward yet intricate principle: there is no need to actually transfer money, only to perform mutual offsets between exchangers located in different places and countries around the world.

How Does It Work? Step by Step

- The process begins in the country from which the money is to be transferred.

As mentioned earlier, Hezbollah receives funding from a source in a foreign country — for example, Turkey:

A local exchanger in Turkey is approached by Unit 190 or another Hezbollah-linked actor, who arranges for a cash deposit to be made directly — for example, $100,000 delivered in a suitcase by a courier.

The Turkish exchanger does not inquire further; he merely notes the deposit for his own records. No formal bank transfer takes place, no paperwork is generated, and no digital footprint is left behind for intelligence services to trace. - Simultaneously, in Lebanon — the money is received.

Another exchanger in Lebanon (one of the six offices mentioned in this document), who is a partner in the same Hawala network with the Turkish exchanger, hands over the same cash amount to Hezbollah representatives in Lebanon.

Again, no actual bank transfer is made. No documentation, no invoices, and no digital traces. - A hidden debt is created between the exchangers.

A situation of a hidden debt is formed — the Turkish exchanger is now “indebted” to the Lebanese exchanger for the $100,000.

They do not need to close the offset immediately — they simply keep an agreed-upon internal record. Exchangers are patient about closing the offset, and it can even be settled in stages over time. - An unrelated client arrives — and helps close the offset.

Another customer, for example, a Lebanese resident who wants to send money to his son studying in Turkey, comes to the Lebanese exchanger and gives him a certain sum.

That Lebanese exchanger then contacts the Turkish exchanger and asks him to deliver the corresponding amount that was already deposited to the Lebanese student in Turkey — and so the loop is closed.

In this way, the money “moved” from one country to another, even though it never physically left either country. The money was “transferred” in practice, without being physically moved.

This method is ideal for terrorist organizations because there is no formal documentation, no use of the global banking system that can detect suspicious patterns, and no geographic boundaries. All that’s needed is a network of trust between exchangers. It is extremely difficult to incriminate those involved — since each participant can claim they did not know the purpose of the money.

Characteristics of the Exchange Offices

The exchange offices examined in this document share several common features, including notable geographic concentration in key areas such as the Hamra neighborhood in Beirut and the Beqaa region — areas considered strongholds of Hezbollah’s influence and control. These offices also maintain tight sectoral connections and an outward appearance of legitimate business credibility. Most are family-run enterprises, protected either by local clans or operating under Hezbollah’s patronage.

The exchange offices mentioned here are not fringe players. They are well-known establishments, some of which hold a Category A license from the Bank of Lebanon, which grants them permission to transport cash and precious metals and to operate in international markets.

It is precisely this formal legitimacy that makes it more difficult to detect their activities in service of Hezbollah.

How Can the Exchange Axis Be Confronted? Is It Even Possible in Lebanon?

Addressing the exchange axis requires a deep understanding of Lebanon’s business culture, its tribal and sectarian structure, the political, security, and civilian pressures at play, and the impact of the fear factor associated with Hezbollah on how exchangers behave. It also requires the ability to distinguish between a legitimate business and one serving as a tool for a terrorist organization.

Will the new directive issued by the Bank of Lebanon on July 14, 2025, in response to international pressure (mainly American), actually result in revoking the licenses of the six exchange offices listed in this document?

Will the Bank of Lebanon sever all ties with them and ensure that other financial institutions in Lebanon do the same?

We have serious doubts…

(Note – this refers to Directive No. 13735, whose purpose is to protect Lebanon’s financial and economic sector from cooperation with entities that are non-compliant and subject to sanctions by foreign authorities, in accordance with Law No. 44 of November 24, 2015, on combating money laundering and terrorism financing.)

Recommendations to the International Community, Led by the United States

Below are several recommendations we formulated following the collection of open-source information (see appendix) regarding the six exchange offices mentioned in this document, which were identified as direct sources of funding for Hezbollah:

- Imposition of Sanctions and License Revocation.

The only exchange office currently under sanctions is “Hassan Ayash”. Sanctions have also been imposed on its owner.

We found no indications of international sanctions imposed on the other five offices, their owners, or other relevant stakeholders involved in them (“Mecattaf”, “Maliha”, “Yara”, “Al-Sadiq”, and “Al-Insaf”).

In addition, Lebanon should be required to revoke the licenses of these offices.

Furthermore, any entity conducting business with these exchange offices should be exposed to the risk of sanctions.

- Demand for Thorough Examination of Potential Links Between Saradar Bank and Hezbollah.

Ramez Pierre Mecattaf, the owner of the “Mecattaf” exchange office, is also a shareholder in the private Lebanese Saradar Bank.

In light of this, there is a need to examine whether the bank’s platform is also being exploited — directly or indirectly — to serve Hezbollah’s financing axis.

- Shareholding in Saradar Bank by Ramez Mecattaf

Ramez Pierre Mecattaf represents a link between “Mecattaf” and Saradar Bank (via cross-ownership).

Therefore, it is necessary to examine the implications of the Bank of Lebanon’s July 14 directive regarding his continued ability to hold shares in the bank.