Approximately 10 months after the fall of the Assad regime and the establishment of a Sunni Muslim regime in its place headed by President Ahmed al-Sharaa, the struggle for Syria’s future and who will influence the country is also being waged using a new currency: investments in reconstruction.

The ‘transitional’ government (which increasingly appears to be a permanent autocratic regime), led by President Ahmed al-Sharaa, presented an ambitious vision for a “New Syria” in his historic speech at the UN General Assembly in New York on September 24, 2025 (the first time a Syrian president has addressed the assembly since 1967).

According to this vision, the reconstruction plan is intended “to turn a page on a wretched past” and reintegrate the country into the international community.

On behalf of this vision, since coming to power, al-Sharaa has been projecting moderate positions in a calculated messaging campaign to the West, while establishing an army composed in significant part of Sunni jihadist militias supported by Turkey, and while his forces carried out massacres against the Druze (July 2025) and Alawite (March 2025) minorities.

Additionally, the first buds of systematic education for jihadist values are emerging in Syria, such as the video that was circulated showing a teacher in a Damascus school teaching hundreds of children that the state’s constitution is the Quran, and that their goal is “to liberate the Al-Aqsa Mosque” in Jerusalem. Or, In a video filmed recently at one of the schools in Syria, students are seen participating in a morning assembly, standing in rows and repeating aloud after one of the teachers who is making religious declarations of a distinctly ideological / jihadist nature.

Process of Islamization in the Syrian Education System – Morning Assemblies with a Jihadist Character*

— Israel-Alma (@Israel_Alma_org) October 16, 2025

In a recently filmed video from one of the schools in Syria, students can be seen participating in a morning assembly, standing in rows and repeating in unison after a teacher… pic.twitter.com/A3TpBe4uz1

With reconstruction costs estimated at a staggering $250 to $400 billion (and according to al-Sharaa’s statement, could even jump to $900 billion) – a sum far exceeding Damascus’s domestic capacity – the country’s recovery is entirely dependent on foreign capital.

This dependency has created a new geopolitical melting pot. Regional and global powers are competing for influence in Syria through commitments of billions of dollars for infrastructure, energy, and finance.

These investments are strategic tools designed to secure political alignment, economic leverage, and an ideological foothold in Syria, while attempting to push rivals from the arena.

President al-Sharaa, for his part, is skillfully maneuvering between competing patrons to maximize financial benefits while trying to develop a fragile Syrian sovereignty.

The outcomes of this complex interplay will affect not only the future direction of the Syrian state, but also Israel’s northern border.

Al-Sharaa’s Campaign to Attract Investment and Remove Sanctions

Since coming to power, the al-Sharaa government has launched a coordinated diplomatic and economic campaign aimed at securing international legitimacy, the removal of sanctions on Syria, and securing the capital needed for reconstruction.

The Trump administration responded enthusiastically, and passed a presidential order to lift the sanctions on June 30 (an order partially removing the sanctions until Congress passes new legislation).

This campaign culminated in President al-Sharaa’s historic speech before the UN General Assembly, where he avoided Islamist and extremist rhetoric in favor of a pragmatic appeal for investment and stability. This was supplemented by a historic visit to Washington in September 2025 by Foreign Minister Asaad Shaibani, who met with American officials and lawmakers to discuss the removal of sanctions and the path to political normalization.

On the domestic front, the government took seemingly cosmetic steps to address the deep wounds of the war, establishing committees for transitional justice and for investigating the fate of the missing, thereby trying to signal a break from the Assad era.

This external agenda of moderation, reform, and lip service, is built on a dubious foundation.

The new transitional constitution, signed in March 2025, concentrates significant powers in the presidency, raising concerns about transparency and checks and balances.

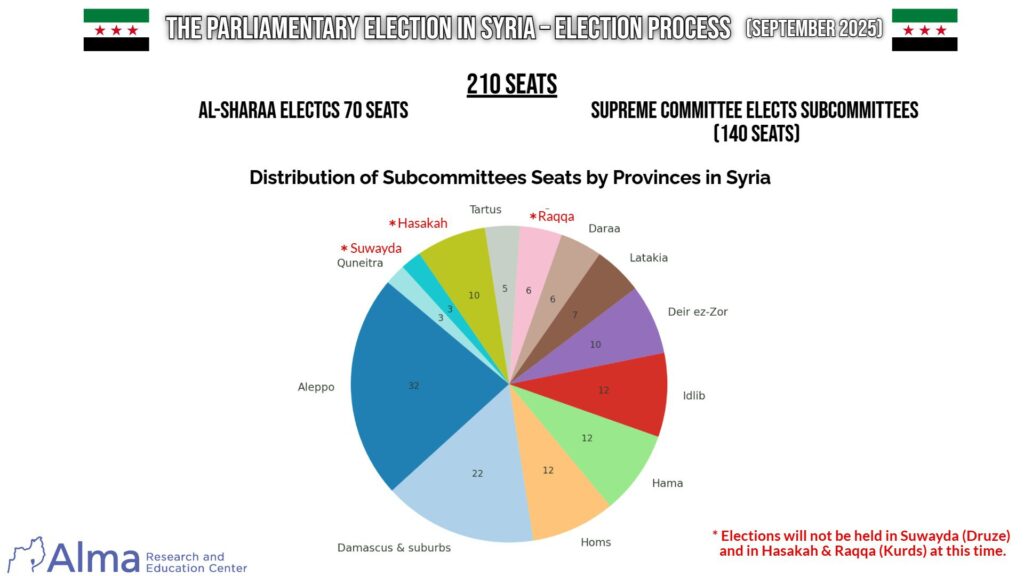

These concerns are amplified by the government’s approach to political inclusion. The Syrian parliamentary elections in October 2025 were planned as an indirect process, with one-third of the seats appointed directly by President al-Sharaa, and the remaining two-thirds of the seats, elected through an indirect election process by pre-appointed committees.

The process includes establishing an electoral body (electoral college) in each of Syria’s provinces. These bodies are the ones that will elect the representatives of the two-thirds to parliament.

More critically, the government announced the indefinite postponement of elections in the provinces of Suwayda (Druze), Hasakah and Raqqa (Kurds), citing security concerns and lack of state control.

The exclusion of these minorities, along with the massacres that erupted this year, demonstrates the gap between al-Sharaa’s statements and the reality on the ground in his country.

Additionally, this dynamic reveals an important pattern: the new Syrian regime is trying to implement economic and social reforms through a politically centralized and exclusive framework.

By marginalizing key groups like the Kurds and the Druze, the government risks perpetuating the same grievances that fueled the civil war, thereby undermining its own narrative of an inclusive “New Syria.”

For the new regime, the primary goal is not deep political reform, but economic stabilization.

The focus on removing sanctions, steps such as launching the Syrian Development Fund, and courting global credit companies like Mastercard, indicates a belief that if Syria can be made stable and open for business, the international community will eventually overlook its lack of democracy, abuse of minorities, and perhaps its rise as a new Islamist factor in the shadow of Hayat Tahrir al-Sham and other Islamist rebel groups that overthrew Assad (the US already removed Hayat Tahrir al-Sham from the list of terrorist organizations in July).

The Reconstruction Gold Rush: A New Arena for Geopolitical Rivalry

The astronomical cost of rebuilding Syria has ignited intense competition for influence, turning the country into an economic battlefield for regional powers.

The Syrian government has sought to manage this flow of capital through domestic initiatives, while navigating the complex agendas of its new patrons.

On September 4, President al-Sharaa launched the Syrian Development Fund, a national institution intended to serve as the primary vehicle for reconstruction.

The fund, established by presidential decree and linked directly to the presidency, aims to channel donations from Syrians living in Syria and abroad, as well as international grants, to rebuild vital infrastructure in sectors like energy, water, health, and education.

Syrian officials have pledged the “highest level of transparency,” with public disclosure of all expenditures.

The initiative was met with a wave of public support, and donations quickly exceeded $82 million.

However, critics have raised serious concerns about the fund’s direct link to the presidency, which could limit independent oversight, and the lack of strict, publicly detailed mechanisms for project selection, creating potential risks for corruption.

Gulf Competition, Turkey’s Advance, and the West’s Return

The most significant financial drivers for Syria’s reconstruction are external, led by an intense competition between the Gulf monarchies and Turkey.

According to a recent analysis published in the Jerusalem Strategic Tribune, this rivalry is not just economic but deeply ideological, centering on the role of political Islam.

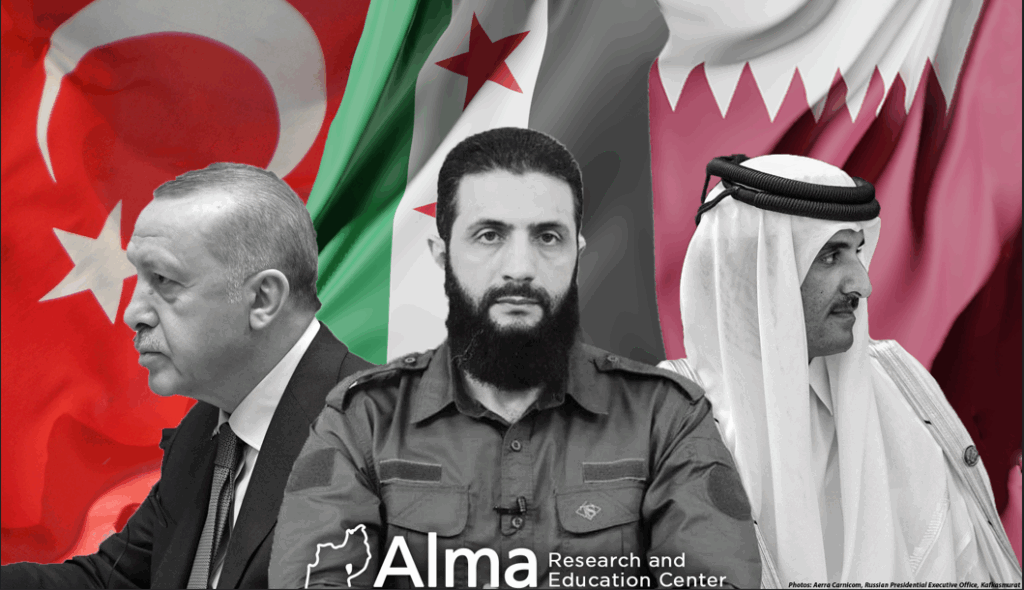

Qatar, a longtime supporter of Islamist movements, acted quickly, pledging more than $7 billion for construction and rehabilitation of power plants and financing natural gas shipments, aiming to shape the new Syria in its image.

Saudi Arabia, led by Crown Prince Mohammed bin Salman, currently views the Muslim Brotherhood as an existential threat, and has pledged $6.4 billion for investment in diverse sectors.

Riyadh’s main objectives are to stabilize Syria, restrain Iranian and Qatari influence, and the Captagon trade that plagued the region under Assad.

Preventing Syria from becoming a client state of its rivals, Turkey and Qatar, is likely a paramount consideration in the Saudi move.

Turkey, meanwhile, has leveraged its geographical proximity and industrial capacity to become a dominant economic force in Syria.

According to Turkish officials, the goal is to reach $10 billion in bilateral trade, and Turkish construction and energy companies are aggressively pursuing the Syrian reconstruction market, estimated at hundreds of billions of dollars.

Ankara is a key partner in huge joint ventures, including a $7 billion electricity generation deal and a $4 billion project to build the Damascus International Airport, for which it also supplied new radar and navigation systems.

This deep economic penetration is not just commercial; it provides Ankara with significant strategic leverage over Damascus, which can be used to leverage deep influence on the al-Sharaa government in security matters, such as the future of the Kurdish-led Syrian Democratic Forces.

This effort is occurring alongside the Turkish effort to play a central role in building the new Syrian army, which includes within it several key militia organizations that were supported by Ankara during the civil war years.

Another significant sign of this change was the return of the global credit company Mastercard to Syria, after a 14-year absence.

The company signed a historic Memorandum of Understanding (MoU) with the Central Bank of Syria to develop a national digital payments system.

Such a move by a large, risk-averse Western financial institution serves as a powerful indicator, and de-risks the Syrian market in the eyes of other potential private sector investors.

Added to this was renewed engagement from international financial institutions, with the World Bank providing an initial $146 million for the electricity grid and the European Union pledging nearly €2.5 billion for 2025-2026.

The Waning Influence of Russia and Iran

Assad’s former patrons saw their strategic status in Syria dramatically collapse overnight.

The fall of Assad was a catastrophic blow for Iran and its Shiite axis, which were deeply entrenched throughout Syria, used it to build another front against Israel, and established through it the Iranian corridor to Hezbollah in Lebanon.

The severing of the land bridge to Hezbollah in Lebanon and the loss of an investment estimated at $20-30 billion, that Tehran invested in supporting the Assad regime over the years, have severely damaged the Iranian axis, economically as well.

Russia (which served as the ‘air force’ of the Shiite axis in Syria against the rebels and against al-Sharaa’s forces), has adopted a pragmatic stance, seeking to preserve its key strategic assets – the naval facility at Tartus and the Khmeimim Air Base (south of Latakia).

However, its economic influence is already being challenged; in a significant move, the new Syrian government terminated the contract of the Russian company Stroytransgaz to manage the commercial port of Tartus, awarding it instead to the UAE-based company DP World.

On October15 , al-Sharaa made a first historic visit to Moscow. The purpose of the visit was to re-establish relations with Russia, define ‘give and take’ relations around Russian interests in Syria, and discuss security and reconstruction issues.

According to reports, al-Sharaa used the visit to request the extradition of the ousted president Bashar al-Assad, who has enjoyed asylum in Moscow after fleeing Damascus in December 2024.

Likewise, al-Sharaa confirmed the continued Russian presence at the Khmeimim Air Base and the Russian naval base in Tartus.

According to reports, al-Sharaa also requested a Russian role in redeploying Russian forces in southern Syria to reduce Israeli security activity in the area.

Conclusion

The new Syrian government, for the foreseeable future, is projecting that it is inwardly focused, and its foreign policy is dictated by the economic needs of reconstruction and the need to court capital from Gulf states and Western countries.

Because of this, Islamist-jihadist messages are indeed downplayed, but they are clearly visible to those who choose to listen attentively to the voices in Syria at the ground level and do not ignore them.

The Iranian-Shiite axis has set and the “Sunni Crescent” – led by Turkey and Qatar – has risen over Damascus, and it is not pro-Israeli or pro-Western by nature, but the opposite.

Turkey, in particular, maintains a hostile position towards Israel, and its potentially deepening economic foothold in Syria presents a new state actor, strong and unpredictable, on the northern border.

Furthermore, President al-Sharaa’s pragmatic turn cannot erase his ideological origins.

The long-term risk remains that after his rule is consolidated, his government might revert to a more hostile stance, while the current policy of centralizing power and excluding minorities raises the risk of a renewed outbreak of internal conflict, creating instability that could easily spill over the border (and not only into Israel, but also into Jordan).

Finally, while Hezbollah has suffered a severe blow, it still remains a threat in Syria as well.

As emerges from research by the Alma Center, Hezbollah (and the Iranians, presumably) continues to use Syrian territory to plan terror attacks against Israel and continues to smuggle weapons through it.

All this will likely not stop the flood of investments and commitments for Syria’s reconstruction, even though it is not at all clear what the nature and state of this country will be in about a decade, or perhaps even tomorrow morning…

One Response

Dear Yaakov,

Thanks for your factual reporting. It is self evident that “reconstruction” is really just a disguise for pouring more radical terrorist ideology influence into the world.

We cannot have ANY repetition of the Gaza saga.

NO RECONSTRUCTION WITHOUT DERADICALIZATION.

And deradicalization needs to start in Qatar and Turkey and the UN with the ending of the Aljazeera and child indoctrination propaganda war.